Who Should Get Life Insurance and Who Benefits from It?

Who Should Get Life Insurance and Who Benefits from It?

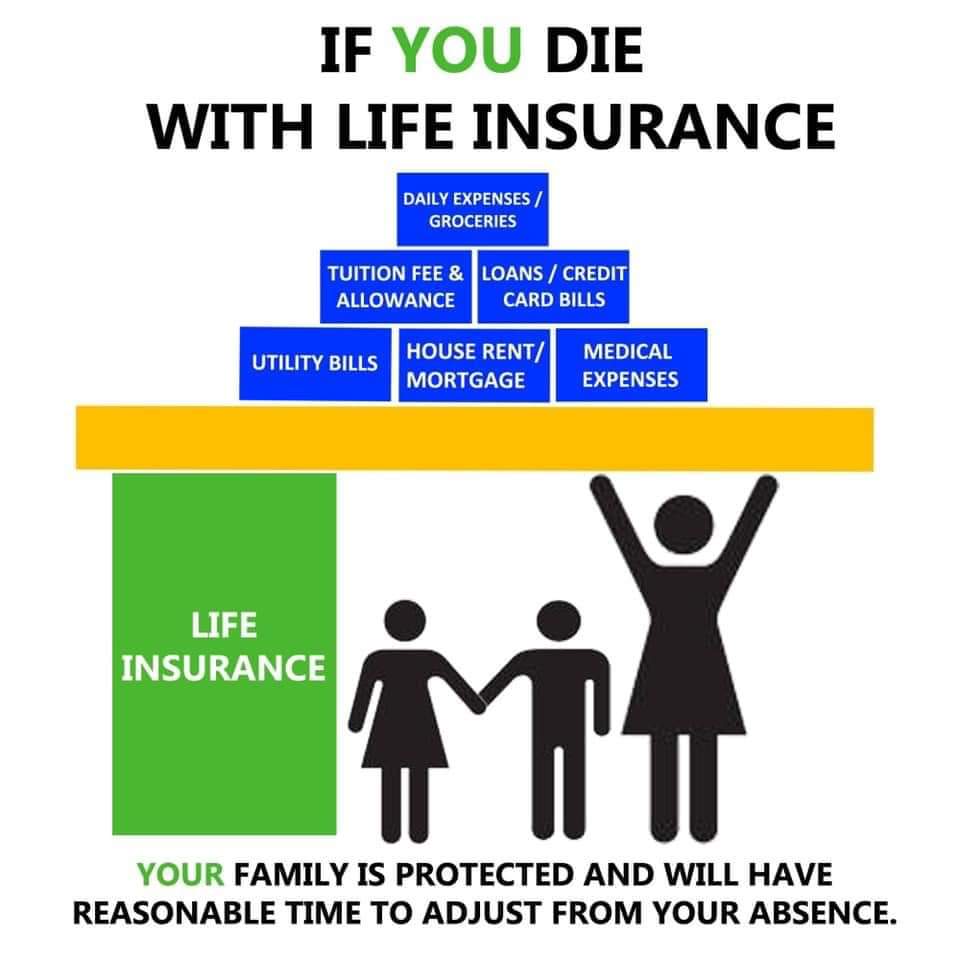

Life insurance is a cornerstone of financial planning, but it's not always clear who should prioritize purchasing a policy. Understanding who should get life insurance and who stands to benefit from it can help you make an informed decision about whether it’s right for you. This guide will explore the various scenarios in which life insurance is beneficial and identify the individuals and groups who gain from its coverage.

Who Should Get Life Insurance?

Life insurance is not a one-size-fits-all product. Different life stages and circumstances can influence the need for coverage. Here are key groups of people who should consider getting life insurance:

1. Breadwinners:

If you are the primary income earner in your family, life insurance is essential. It ensures that your family can maintain their standard of living and cover essential expenses if you pass away unexpectedly.

2. Parents:

Parents, especially those with young children, should have life insurance to provide for their children's future needs. This includes covering living expenses, education costs, and other financial requirements.

3. Homeowners:

If you have a mortgage, life insurance can ensure that your family can continue to live in their home by paying off the mortgage in the event of your death.

4. Business Owners:

Life insurance can be crucial for business owners to protect their businesses. It can fund buy-sell agreements, cover business debts, and provide financial support to keep the business running.

5. Individuals with Debts:

If you have significant debts, such as student loans, car loans, or credit card balances, life insurance can prevent your family from being burdened with these debts after your passing.

6. Stay-at-Home Parents:

Even if you don’t earn a salary, your role has immense value. Life insurance can cover the cost of services you provide, such as childcare, housekeeping, and other household responsibilities.

7. Singles with Dependents:

If you are single but have dependents, such as aging parents or siblings with special needs, life insurance can provide financial support for their care in your absence.

8. Young, Healthy Individuals:

Purchasing life insurance at a young age can be cost-effective, as premiums are generally lower when you’re younger and healthier. This can lock in a lower rate for the future.

Who Benefits from Life Insurance?

Life insurance benefits a wide range of individuals and groups, providing financial protection and peace of mind. Here’s who stands to gain from a life insurance policy:

1. Family Members:

Your spouse, children, and other dependents are the primary beneficiaries of life insurance. The death benefit can replace lost income, cover living expenses, and ensure financial stability.

2. Policyholder:

While the primary purpose of life insurance is to provide for others after your death, it can also benefit you. Knowing that your loved ones will be taken care of provides peace of mind and financial security.

3. Business Partners:

In a business context, life insurance can benefit your business partners by funding buy-sell agreements, ensuring the smooth transition of business ownership, and covering business debts.

4. Creditors:

If you have outstanding debts, creditors can benefit from the life insurance death benefit, as it can be used to pay off these debts, ensuring that your family is not left with financial burdens.

5. Charities:

If you have a philanthropic interest, you can name a charity as a beneficiary of your life insurance policy, ensuring that your legacy supports causes you care about.

6. Estate:

Life insurance can benefit your estate by providing liquidity to cover estate taxes and other expenses, ensuring that your heirs receive the full value of their inheritance without the need to sell assets.

Conclusion

Life insurance is a versatile financial tool that provides crucial benefits to a wide range of individuals and groups. Whether you are a breadwinner, parent, homeowner, business owner, or single with dependents, life insurance can offer financial protection and peace of mind. The primary beneficiaries—your loved ones, business partners, creditors, and even charitable organizations—stand to gain significant support from your policy. Assessing your unique circumstances and consulting with a financial advisor or insurance professional can help you determine the right coverage to meet your needs and provide for those you care about most.